Sales Project IR35

ABOUT THE COMPANY

The Challenge

The Solution

We identified all contractors effected by IR35 (276 contractors supplied by 15+ suppliers and agencies).

We put together an IR35 project team consisting of DC, HR, Payroll Manager and group finance to ensure that all stakeholders were kept updated and nothing was missed. This included weekly stakeholder meetings.

We then audited and reviewed all contractor and agency contracts to ensure IR35 compliance, legal obligation, and applicable clauses to IR35 legislation.

Hired over 50 highly skilled interim consultants in a three year period.

Key stats

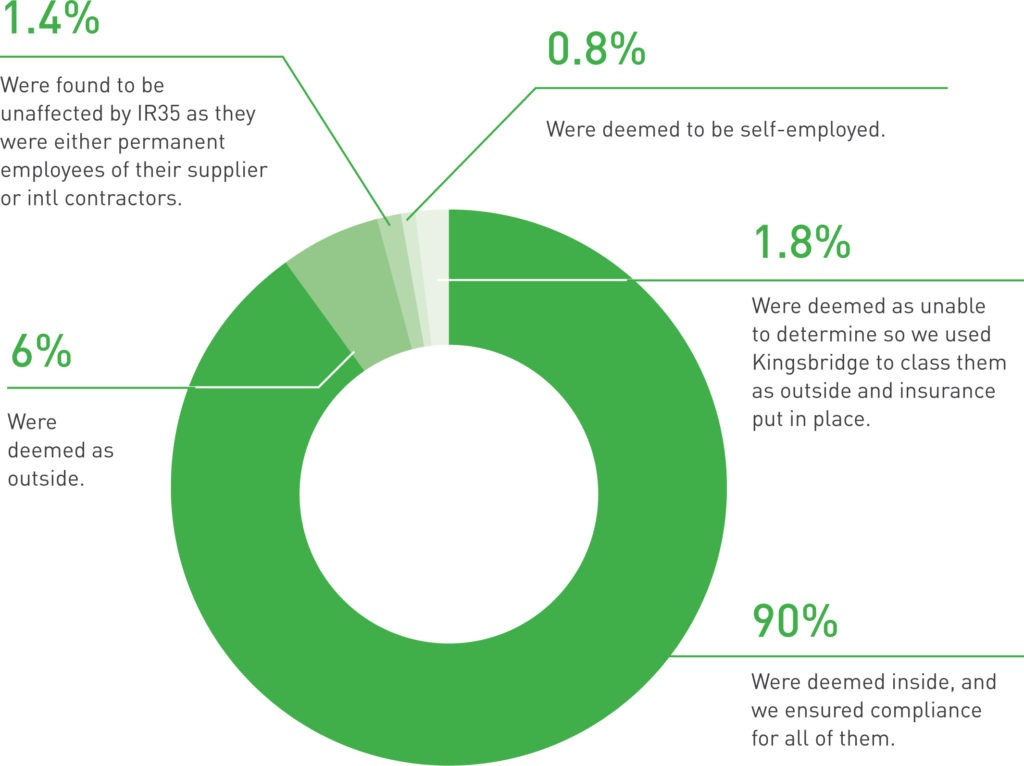

276 current contractors, from 15+ suppliers and agencies were assessed, and solutions identified.

Of those:

Key Elements

HMRC CEST Test

Kingsbridge portal

Kingsbridge Insurance

MS Teams for IR35 project team meetings

Summary Results

We provided full reports back to the IR35 project team of assessment outcomes: – For all contractors that were deemed “inside IR35” we communicated this outcome with the contractors and ensured compliance with their payment method. – For all contractors that were deemed “outside ir35” we communicated this outcome with the contractors and informed them that no changes needed to be made. – For all contractors that were deemed ”unable to determine” we consulted with the IR35 project team and relevant stakeholders to discuss and identify the level of risk to the business before deciding on the best solution.

We consulted with the client and their payroll team to put a contractors payroll in place for all contractors that had their own ltd company but were inside of IR35 so that tax and NI could be deducted prior to the contractor receiving net funds.

Working in partnership with a trusted IR35 specialist insurer, we consulted with them whenever there was a dispute or an “unable to determine” outcome. In most instances this enabled us to class these contractors as outside of IR35 but with insurance in place against that status determination (covering all parties in the supply chain).